Out of college, I lived in a little "vintage" apartment building in Georgetown, a neighborhood of Washington, D.C. According to the terms of the lease, we weren’t allowed to have washing machines and clothes dryers of our own in the apartments, which was okay because there wasn’t room for them anyway. In the basement of the building there were two coin-operated washing machines and two dryers that each cost 75¢ to operate. Neither of the dryers worked well enough to get the clothes dry in one pass, so unless you had a very small load of laundry, you had to pay for two cycles.

Okay. So, 75¢ plus 75¢ plus 75¢ equals $2.25 for a load of laundry, not counting the cost of detergent. Including sheets and towels as well as clothes, I did two loads a week. So laundry cost me $4.50 per week.

No big deal, right? Well, right. It was no big deal. Paying a measly $4.50 is a lot better than having to invest in a washer and dryer. I only planned to stay in that building for a couple of years, so I didn’t even see the situation as permanent. To tell you the truth, I never even thought about it one way or the other. I just did my laundry, as one does.

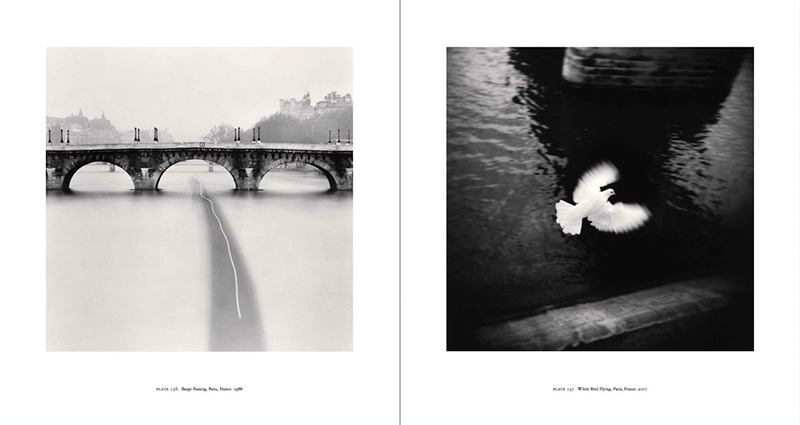

Life went on. One thing led to another, and I ended up working as a freelance photographer. Georgetown is a nice central location for a working photographer who has to get all over D.C. on short notice. Long story short, I ended up staying in that apartment for seven years.

When I finally did move, I also "moved up in the world." My next apartment was a lot nicer. Just off the kitchen, it had a separate room just for a washer and dryer, complete with the water hookups and dryer vent and those special outlets for the big beefy plugs. As Homer* would say, woo-hoo! But no machines. Again, no big deal. I headed down to the local Sam’s Club and bought a plain, bargain-priced washer and dryer set for $500.

That’s when it suddenly occurred to me to sit down and do a little arithmetic. It’s when I first figured out that laundry in my old building used to cost me $4.50 a week. And I had stayed there for seven years.

Seven years x 52 weeks a year x $4.50 equals…

¡Ay caramba!

If you just did the arithmetic too, you realize I had paid $1,638 for the use of the cruddy laundry machines in the dank, smelly basement of my old apartment building—more than three times what my own new machines had cost!

True, I did have to pay for electricity in the new building, and not in the old building. But even generously allowing for a buck’s worth of electricity per load in the new building—probably more than it really cost—the most I would have paid for laundry in seven years using my own machines was $500 for the machines plus $728 for electricity, or $1,228.

Over seven years, I would have saved at least $410 on laundry.

And that’s not even taking to account that at the end of the seven years in the new building, I would still own a seven-year-old washing machine and dryer worth maybe $200 or so. So just by being wealthy enough to buy my own laundry machines up front, instead of having to pay to use someone else’s, I would come out at least $610 ahead on laundry. And probably more.

It's like I always say, the reality of having no money is that it costs more. Not "more" in any diffuse general sense, taking into account intangibles like limitations on life choices and personal satisfaction: it just costs more in plain ol' money.

Question for you

So let me ask you a car question: Let's say you have a daughter who just graduated from college. She's living in a new city and she needs a car. She's saved up $5,000 for it, and she's looking at three choices:

1. Buying a used car outright off AutoTrader or Craigslist and paying cash for it.

2. Buying a certified used car from a dealership, paying $1,500 or $2,000 down and financing the rest. (Getting financing isn't a problem because you—her parent in this exercise, remember—are willing to co-sign.)

3. Buying an inexpensive new car with money down and financing.

Some considerations:

• The advantage of Option 2 is that she'll probably get a better, newer car, and she'll help her credit rating, which, as a new college graduate, is nonexistent. Plus, the dealer might offer a limited warranty. The problem with Option 2 is that most dealers don't bother with used cars cheaper than about $10k, so the car she buys is going to cost a fair amount more than $5k in the long run.

• The advantage of Option 3 is that she'll very likely get a known quantity, a new car with no reliability issues, and a full new-car warranty. The problem is that the cars in her price range are going to be among the cheapest new cars you can buy, and cheap new cars often have less residual value after the term of the loan is over.

What would you advise?

Mike

*Not the poet.

"Open Mike," which appears only but not always on Sundays, is the off-topic page of TOP. Not that I stay on topic the rest of the time, but whatever....

P.S. "It Costs More to be Poor" Part I is here.

[UPDATE: The daughter and parents in question are the ones in this post. —Ed.]

Original contents copyright 2015 by Michael C. Johnston and/or the bylined author. All Rights Reserved. Links in this post may be to our affiliates; sales through affiliate links may benefit this site.

(To see all the comments, click on the "Comments" link below.)

Featured Comments from:

David Zivic (partial comment): "I have had good experiences buying dealer certified used cars. I would advise putting 20% down and paying for, not financing, tax and license. Then should a rainy day arrive she will not be upside down with the loan."

Ruby: "We went with Option 1 for our son; however, it took six months to find the right car, and my brother-in-law is a mechanic and looked over every car we considered at his shop at no cost to us—including a couple of used cars from dealerships. We lucked into a client of my husband's who liked to buy cars and use them for about six months, spruce them up, and then sell them. We were able to find him a nice, low-miles 2002 Mazda that continues to serve him well. We had both time and a free inspector working in our favor, which made this option more attractive.

"Option 3 will cost more for insurance, and that is part of the long-term cost analysis.

"I ran this past my husband (who is a financial consultant), and he said Option 2 is the best choice in these circumstances. We got our own car from CarMax, and he said that was the most pleasant car-buying experience he's ever had. I've been driving that car for five years now. My brother-in-law the mechanic also bought his truck this way.

"I wish this new graduate luck and a reliable car at the right price."

MarkB (partial comment): "...More debt is that last thing any recent college graduate needs, regardless of the co-signer. Personally, I think tooling around in a paid-for car feels a lot better than sending off a check every month or getting into the habit of buying things on credit or leasing."

latent_image: "I'm no financial wizard though I am cheap when it comes to cars. Best purchase so far has been a certified used car. Two year/40,000 km. warranty. I knew what I wanted and used the manufacturer's website to locate a car in my region. Managed to talk the price down, too."

Jim Hamstra: "For 55 years I have followed Option 1 and saved a lot of money in the process. Nowadays I buy from a private owner and try to find a car around three years old with around 30,000 miles which sells for half or less of new price. If you buy a well maintained dependable model you should be able to drive it for over 100,000 miles and it will still have some value when you sell it. It's great to have no debt and another benefit is cheaper insurance and registration.

"One example: Many years ago I bought a three-year-old Honda and put 100,000+ miles on it then sold it to a guy that wanted it for his wife. Ten years later I found out the rest of the story when I met a lady who asked if I remembered the car. Her husband bought it for her then divorced her. She drove it for several years then gave it to her daughter to drive while in college. After that her son wanted it for his car while in college. She then told me he had just graduated and had sold the Honda—for the same price I had sold it to her husband ten years earlier."

David: "While in graduate school, I lived in apartment without a washing machine or drier, so I used a nearby laundromat, where I deposited many coins. But, I also met my future wife there, which made me far richer than I can say! YMMV."

John Camp: "You have to make a story out of it to make the call. She's a college grad in a new city, which I would suggest means that she has some kind of a job where a college degree has some importance. In that case, I'd say Option 2, the cheapest decent car she can get with the lowest down payment (you suggest $1,500) financing the rest.

"Then take the $3,500 and make a wholesale marijuana purchase, and start dealing to the other low-level college grads at your workplace. At that scale, you should be able to double your money every week, for a month or so, assuming that the job pays you enough to live on, so you don't cut into the dope profits. If you don't try to pyramid your profits (which could attract the eye of the cops) and are content with a relatively small network of regular, well-vetted users—say 20 members, buying an ounce of high-quality bud a week—you should be able to yank down a hundred thousand a year with no taxes. And then, you know, buy a Jag, one of those electric red convertibles, and get rid of that piece of sh*t your parents co-signed for. And get some decent threads, too."

Mike replies: And you think you're going to be able to turn it off and retire. Right!

Steve Rosenblum: "I agree completely with what Jim Hamstra said. I have been through this with all three of my kids. If she can afford it, buy a three-year-old reliable car such as a Honda Accord, Camry, or similar. Find a reliable honest mechanic and insist that any car that is seriously considered gets checked over by the mechanic. Tell the mechanic the car is for your (or whoever's) daughter and that you need to know it is safe and reliable for her. These cars are capable of going 200K miles or more with good maintenance. The car will cost a third to a half less than a new car. One of my kids is still driving the 2002 Accord that was purchased in this fashion and it runs great. Resist buying a very old car because it's cheap. Safety features have steadily improved over the last decade and you want your family member to be well protected. Remember, the car may well be kept for many years and the safety features will be frozen at the year it was produced."

gary bliss: "Hmmm. Among my other professional duties, I do this sort of thing for DoD. And, as several people have said, 'it depends on the price difference among the options.' Sadly—and there is a story here to complex to go into but well documented in, among other places, The Wall Street Journal—the days when you could routinely find three- or four-year-old clean sub-compact cars discounted 33 or 45% over MSRP dried up about three years ago. That car is maybe 20% less than new, and often more. The $10k used sub-compact in the DC area (particularly a Toyota, Mazda, or Honda) is more like a seven-year-old model with 100k miles. Ouch; I would take new for that choice. So you really must factor everything in—including insurance as one poster noted.

"It really very much depends on the used car deals, but the market has finally responded to the truth: cars are far more durable than they were even 20 years ago. And dealer warranty packages are generally, as noted, poor deals due to the 'outs' in the wording."

Juan Flores (partial comment): "The warranty is of tremendous benefit when buying a used car.

"About ten years ago we purchased a car in seemingly good condition from a dealership (and our regular mechanic checked it over and found no faults), then during the course of the six-month warranty the dealer was obligated to repair the various faults that arose, which ultimately exceeded the price we had paid for the vehicle. The car then gave us five years of faultless service.

"I believe that many latent issues a second-hand car might have will be more likely to become evident early on, so a short warranty nicely offsets the premium you would pay vs. purchasing a used car via AutoTrader."

dale [all sic]: "too bad I just sold my 2008 volvo c30 t5, a very fun car, it great shape had my mechanic provide a complete pre sale inspection with the only item was plan on rear brakes in a few months ($400). only a lean 165k for volvo mileage. its old quickly for $4k."

Mike replies: I assume that last line was a typo? :-)